Introduction

Managing personal finances has become increasingly accessible, thanks to platforms like GoMyFinance.com. Whether you’re tracking expenses, planning budgets, or diving into investment strategies, understanding the billing process on such platforms is crucial to maximizing your experience. In this comprehensive guide, we’ll explore GoMyFinance.com bills, from their structure to payment methods, common issues, and tips for better management.

What is GoMyFinance.com Bills?

GoMyFinance.com is a cutting-edge personal finance platform designed to help users achieve financial clarity and control. It offers tools for budgeting, expense tracking, savings planning, and even investment monitoring. Whether you’re an individual looking to get your finances on track or a business owner aiming to streamline your financial operations, GoMyFinance.com provides solutions tailored to diverse needs.

One essential aspect of using the platform is understanding its billing system. This ensures users can access its features without unexpected financial surprises and can optimize their subscription choices.

Why Understanding the Billing Process Matters

For any subscription-based service, the billing process is more than just about payments. It’s about transparency, trust, and ensuring that users are fully aware of what they are paying for. Here are some reasons why knowing the billing structure of GoMyFinance.com Bills is essential:

- Budget Planning: Knowing the billing frequency and cost helps you align it with your monthly or yearly financial plans.

- Avoiding Hidden Costs: Detailed billing knowledge ensures you don’t encounter unexpected charges.

- Maximizing Value: Understanding what each subscription tier offers helps you choose the plan that best suits your needs.

- Efficient Management: With clear billing policies, users can easily handle upgrades, cancellations, or refunds.

Also read: Luther social media maven keezy.co

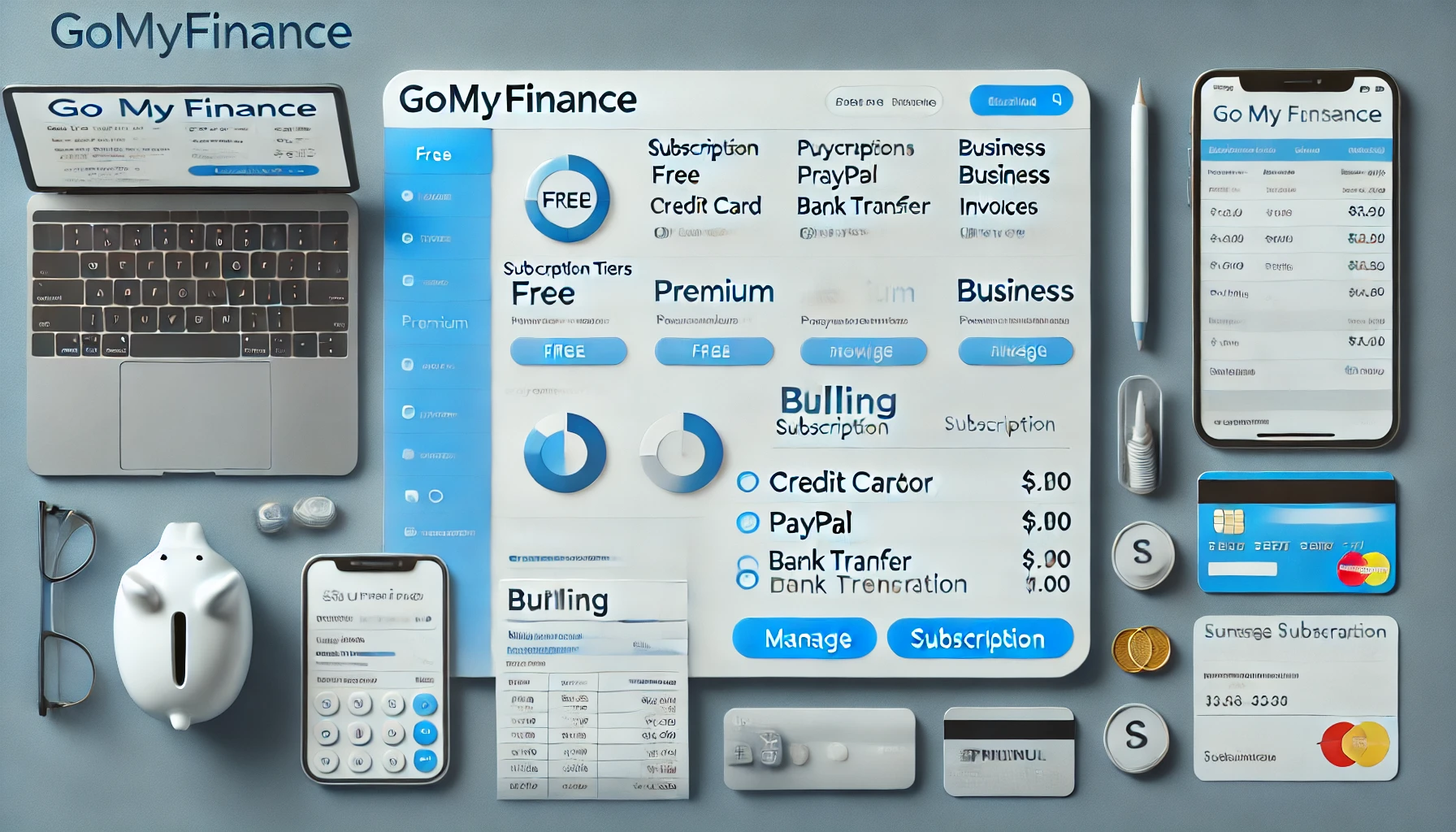

GoMyFinance.com Subscription Tiers and Features

GoMyFinance.com operates on a subscription-based model, offering different tiers of service to cater to varying user needs. Below is an overview of the primary subscription tiers:

1. Free Plan

The Free Plan is designed for users who want to test the platform’s basic features without committing to a paid plan GoMyFinance.com Bills. Features typically include:

- Basic budgeting tools.

- Limited transaction tracking (e.g., up to 100 transactions per month).

- Access to general financial tips and reports.

2. Premium Plan

The Premium Plan unlocks advanced features for users who need more robust financial management tools. It includes:

- Unlimited transaction tracking.

- Customizable budgets and financial goals.

- Advanced analytics and reporting tools.

- Priority customer support.

3. Business Plan

The Business Plan caters to entrepreneurs and business owners, offering tools to streamline business finances. Features include:

- Integration with accounting software.

- Multi-user access for team members.

- Expense categorization specific to business needs.

- Detailed business reports for tax preparation.

How GoMyFinance.com Bills Users

The billing process on GoMyFinance.com is straightforward but varies based on the chosen subscription tier. Here’s how it works:

1. Billing Frequency

Users can choose between monthly and annual billing cycles. While the monthly option offers flexibility, the annual billing plan often includes a discount, making it a more cost-effective choice for long-term users.

2. Accepted Payment Methods

GoMyFinance.com Bills supports a wide range of payment methods to accommodate its global user base. These include:

- Credit and Debit Cards: Visa, Mastercard, and American Express are widely accepted.

- Digital Wallets: Services like PayPal provide an additional layer of security.

- Bank Transfers: For users who prefer direct payments.

- Cryptocurrency (Optional): Some regions support cryptocurrency payments as an innovative option.

3. Invoice Delivery

After every billing cycle, users receive a detailed invoice via email. This invoice outlines:

- The subscription tier.

- The billing amount.

- Applicable taxes or fees.

- The next billing date.

Invoices are also accessible through the user dashboard under the “Billing History” section.

Common Billing Issues and How to Solve Them

Despite its user-friendly design, users may occasionally encounter billing-related issues GoMyFinance.com Bills.

1. Failed Payments

Problem: Payment declines due to insufficient funds or expired payment methods. Solution: Update your payment details in the “Account Settings” section. Ensure your account has sufficient funds or use an alternate payment method.

2. Unexpected Charges

Problem: Users may notice unrecognized charges, often due to auto-renewal settings. Solution: Check your subscription settings to ensure auto-renewal is intentional. Contact customer support for clarification on charges.

3. Difficulty Cancelling Subscription

Problem: Users struggle to locate the cancellation option. Solution: Navigate to the “Manage Subscription” section in your account settings. Follow the step-by-step guide to cancel, and ensure you receive a confirmation email.

4. Delayed Refunds

Problem: Refund requests may take longer than expected. Solution: Review GoMyFinance.com’s refund policy to understand processing times. If delays persist, reach out to customer support with your transaction ID for assistance.

GoMyFinance.com Bills Refund Policy

Transparency is at the core of GoMyFinance.com’s refund policy. Here are the key points to note:

- Eligibility: Refunds are generally available for annual plans if canceled within the first 14 days.

- Processing Time: Refunds typically take 5–10 business days to reflect in your account.

- Non-refundable Charges: Monthly subscriptions and partially used annual plans may not qualify for refunds.

Managing Your Billing Information

To ensure smooth billing experiences, users can manage their billing details through the GoMyFinance.com platform. Here’s how:

Updating Payment Information

- Log in to your account.

- Go to “Account Settings” and select “Billing Information.”

- Update your payment method and save changes.

Viewing Billing History

- Access the “Billing History” section in your dashboard.

- Download invoices for past payments.

- Review transaction details for discrepancies.

Adjusting Subscription Plans

- Navigate to the “Subscription” tab in settings.

- Select “Change Plan” to upgrade or downgrade your subscription.

- Confirm changes to update billing amounts for the next cycle.

Tips for Managing GoMyFinance.com Bills Effectively

- Set Alerts for Renewals: Use calendar reminders to stay informed about upcoming subscription renewals.

- Review Your Plan Regularly: Assess whether your current plan still meets your needs. Downgrade if necessary to save costs.

- Use Discounts: Take advantage of promotional offers and discounts on annual plans.

- Monitor Billing History: Periodically review your billing history to ensure accuracy and detect unauthorized charges.

- Leverage Free Trials: Explore free trials before committing to a premium plan to evaluate its value.

GoMyFinance.com’s Customer Support for Billing

GoMyFinance.com Bills prides itself on responsive customer support, especially for billing inquiries. Users can contact the support team through:

- Email Support: Expect responses within 24–48 hours.

- Live Chat: Available for real-time assistance.

- Help Center: Includes FAQs and guides for self-help.

- Phone Support: Premium users may have access to dedicated phone support for quicker resolutions.

Future Developments in GoMyFinance.com’s Billing System

To stay ahead in the competitive personal finance market, GoMyFinance.com plans to introduce several improvements to its billing system, such as:

- Custom Billing Options: Allowing users to customize billing cycles to match their financial planning.

- AI-Powered Alerts: Automated reminders for payment due dates and upcoming renewals.

- Cryptocurrency Integration: Expanding support for digital currencies in more regions.

- Loyalty Discounts: Rewarding long-term users with discounts on renewals.

Conclusion

The billing process at GoMyFinance.com Bills is designed to be transparent, efficient, and user-friendly. Whether you’re a casual user on the Free Plan or a business owner leveraging the Business Plan, understanding the billing system is key to making the most of the platform’s features. By staying informed about subscription tiers, payment methods, and customer support options, users can enjoy a seamless experience while managing their finances effectively.